estate income tax return due date 2021

Also to note that the Schedule K-1 should be properly filled if the trust has transferred an asset to a beneficiary and claimed a deduction for that. If the donor died during 2021 Form 709 must be filed not later than the earlier of.

.png?sfvrsn=10a6f687_3)

Iras Tax Season 2022 All You Need To Know

Deadline to file your taxes.

. Any income tax liability of the estate or trust. Form T1032 must be filed by the filing due date for the 2021 return. That is because the attorney or accountant that applied for the ID number may not understand when the tax.

An estates tax ID number is called an employer identification. The Estate Tax Exemption. The decedent and their estate are separate taxable entities.

13 rows Only about one in twelve estate income tax returns are due on April 15. For tax year 2017 the estate tax exemption was 549 million for an individual or. If the tax year for an estate ends on June 30 2020you must file by October 15 2020.

For 2020 they were due on July 15 and September 15. The due date for federal fiduciary income tax returns depends on whether the estate has elected a calendar year or fiscal year. You dont have to file your return yet but your estimated payment must be postmarked by this date.

Each calendar year the state income tax due date may differ from the Regular Due Date because of a state. We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference. Deadline to file your taxes if you.

Deadline for filing a 2021 calendar-year C corporation or calendar-year estatestrusts tax return or extension. Before filing Form 1041 you will need to obtain a tax ID number for the estate. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

Due date for first installment of 2022 estimated tax payments. Sometimes a capital property is gifted. The election is made separately for each tax year and must generally be made by the due date including extensions of the income tax return.

The 2021 rates and brackets were announced by the IRS here What is the form for filing estate tax return. Mam I am your customer in filing my income tax return since 2020 and 2021 but all of these were all rejected by IRS due wrong birth date in 2020 and lack of form 8962 in 2021 would you please generate. Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will probably say that the Form 1041 is due on April 15.

Due Date for 4th Quarter 2021 Estimated Tax Payment. Generally both the final return of the deceased and the return for their surviving spouse or common-law partner who was living with them are due on or before the following dates if neither person was carrying on a business in 2021. Since 2013 the IRS estate tax exemption indexes for inflation.

For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041. Filing dates for 2021 taxes. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by.

After that date unclaimed 2021 refunds become the property of the Department of the Treasury. 10 of income over 0. January 15 2022.

B Number of Schedules K-1 attached see instructions. Income Tax Deadlines And Due Dates. The fiduciary of a domestic decedents estate trust or bankruptcy estate files Form 1041 to report.

Deadline to contribute to an RRSP a PRPP or an SPP. The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year. 265 24 of income over 2650.

The federal estate tax return has to be filed in the IRS Form 1041 the US. This date is important to you if you are self-employed or received other income in the fourth quarter of 2021 for which you need to pay estimated taxes. If the section 645 election hasnt been made by the time the QRTs first income tax return would be due for the tax year beginning with the decedents death but the trustee and executor if any have decided to make a section 645 election then the.

In the table below you will find the income tax return due dates by state for the 2021 tax year. 29 years of experience as a tax real estate and business attorney. Gifts and Income Tax.

Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. April 18 2022 or the extended due date granted for filing the donors gift tax return. The due date with extensions for filing the donors estate tax return.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. Calendar year estates and trusts must file Form 1041 by April 18 2022. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year.

This extension does not extend the time to pay the tax. IRS Form 1041 US. It took a big jump because of the new tax plan that President Trump signed in December 2017.

Also known as an estate income tax return may need to be filed if the. The due date of this return depends on the date the person died. April 15 falls on a business day in 2021 and this year is not a holiday so the deadline to file your 2020 personal tax return is April 15 April 2021-Estimated tax payments for tax year 2020 IRS Form 1040.

Any taxes owing from this tax return are taken from the estate before it can be settled. Of the estate or trust. Dates set in 2021 for 2020 returns-Income tax returns of individuals.

They would apply to the tax return filed in 2022. Apr 30 2022 May 2 2022 since April 30 is a Saturday. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

The due date with extensions for filing the donors estate tax return. A homeowners association elects to take advantage of the tax benefits provided by section 528 by filing a properly completed Form 1120-H. If the property was acquired as part of a gifting arrangement that is a tax shelter the eligible amount will be reported in box 13 of T5003 slip Statement of Tax Shelter Information.

The income deductions gains losses etc. Income Tax Return for Estates and Trusts. Due date of return.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. January 24 2022 is the first date that the IRS will accept 2021 federal income tax return filings. If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year.

If the due date falls on a Saturday Sunday or legal holiday you can file on the next business day. Deadline to claim a 2018 tax year refund.

Business Income Tax Malaysia Deadlines For 2021

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

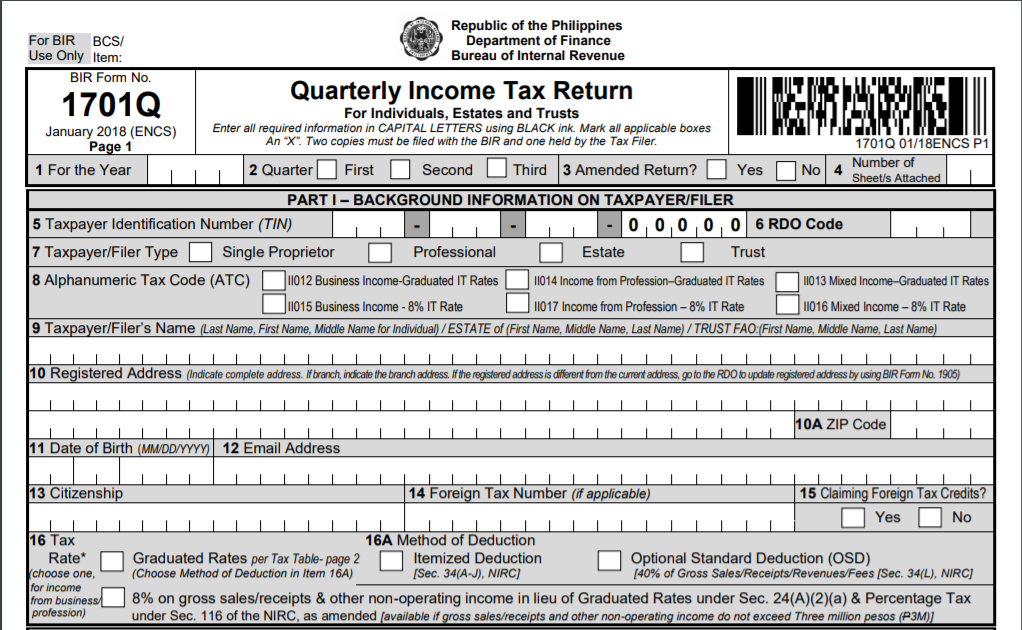

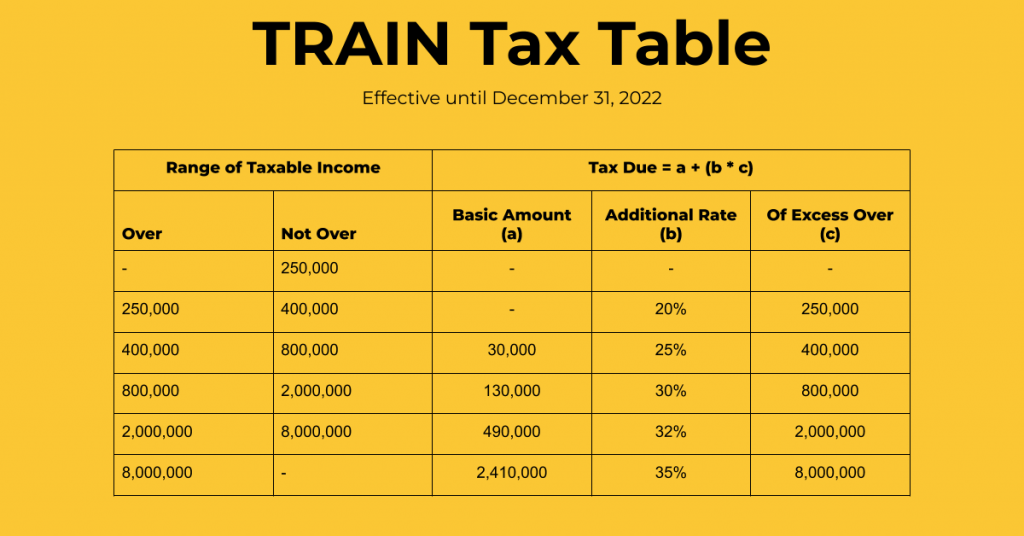

How To File Bir Form 1701q A Complete Guide For 2021

Itr Filing Online For Fy 2021 22 Ay 2022 23

.png?sfvrsn=34046ffe_3)

Iras Tax Season 2022 All You Need To Know

Irs Tax Return Forms And Schedule For Tax Year 2022

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Itr Filing Online For Fy 2021 22 Ay 2022 23 Ebizfiling

Income Tax Refund Not Received L Last Date Of Filing Itr L Itr Refund

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

How To File Bir Form 1701q A Complete Guide For 2021

Canadian Tax Return Deadlines Stern Cohen

Important Changes For Filing Itr For Ay 2021 22

.png?sfvrsn=1cb3b992_3)

Iras Tax Season 2022 All You Need To Know

Business Income Tax Malaysia Deadlines For 2021

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition